Issue 15 | AOFM Investor Insights | July 2024| PDF

Introduction

The Australian Office of Financial Management (AOFM) issued its first Green Treasury Bond on 4 June 2024. The previous edition of Investor Insights focused on the Green Treasury Bond program, the rationale for issuing green bonds, and the important role of investor engagement. This edition focuses on the post-deal analysis and outlook.

In April 2023, the Treasurer announced plans to introduce a green bond program. The Green Bond Framework was published in December 2023. The launch of the first Green Treasury Bond is a significant green milestone and demonstrates Australia’s strong commitment to achieving net zero and improving environmental outcomes.

This paper discusses:

- The June 2034 Green Treasury Bond syndication deal

- Investor engagement during the Green Treasury Bond roadshow

- Green Treasury bond vs conventional bonds syndications

- Green Bond investor categories

- The outlook for green bond issuance

The June 2034 Green Treasury Bond syndication deal

On 3 June 2024, the AOFM launched the inaugural $7 billion June 2034 Green Treasury Bond. Initial price guidance for the issue was set at a spread of -5 to -1 basis points to the implied bid yield for the primary ten-year Treasury Bond futures contract. There was a quick start to the bookbuild after the launch. The book reached $20 billion after midday and $25 billion by the afternoon. This allowed the AOFM to reframe the pricing to EFP –5 to –3 basis points. The bond was priced on 4 June 2024 at a spread of –3 basis points, the middle of the launch range. The pricing of the bond demonstrates strong investor demand for the green bond label.

The bond priced at a yield to maturity of 4.295%. It attracted strong demand from investors, with a final order book of $22.89 billion, more than three times the $7 billion transaction size.

The AOFM and market participants estimated a ‘greenium’ of approximately 2 basis points. A ‘greenium’ is the amount by which the yield on a green bond is lower than a comparable conventional bond. The greenium implies investors are willing to pay a small premium for investing money to finance environmental and net zero transformation projects for Australia.

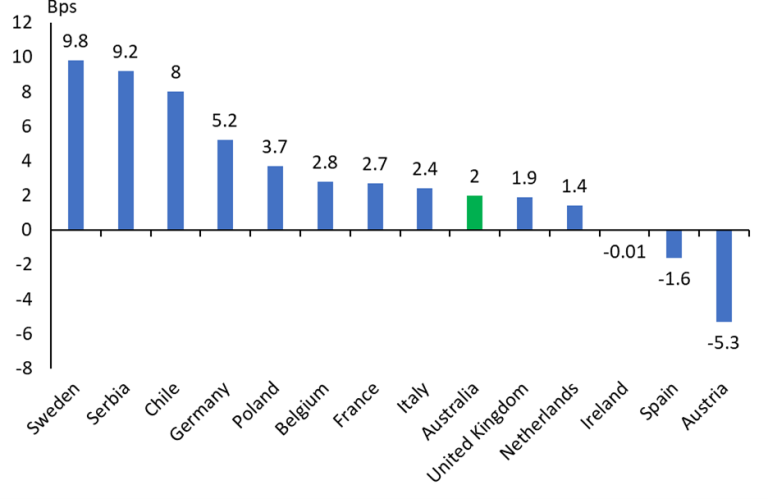

The IMF estimates greeniums in developed economies to be around 2 to 3 basis points. A 2 basis points greenium is broadly in line with other sovereign greeniums at their inaugural issues (Chart 1) with some notable larger exceptions.

Chart 1: Greenium across sovereigns

Source: IMF - How Large is the Sovereign Greenium? April 2023; AOFM. Greeniums calculated at initial issuance.

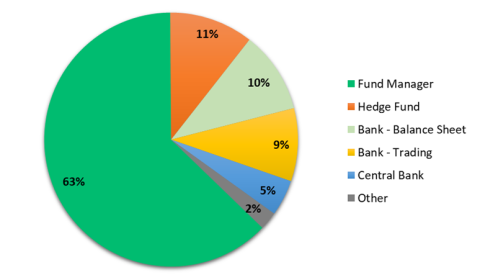

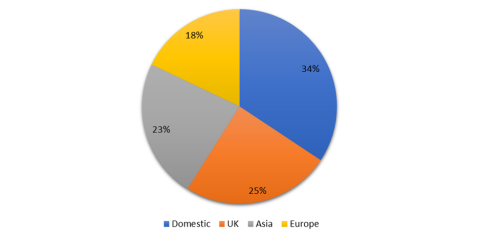

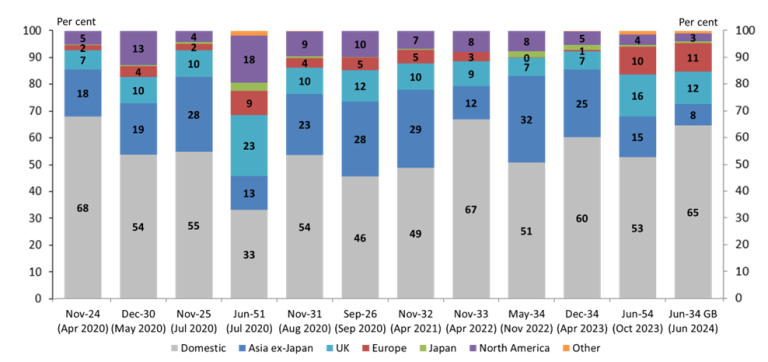

The bond issue was well supported by domestic investors with around 65% allocated to them. It was also well received by a broad range of investor accounts including fund managers, balance sheets, official institutions, hedge funds and bank trading. The highest allocation by investor type was 63% to fund managers (Chart 2). Over 100 institutional investors[1] were allocated bonds, of which 17 were new to AOFM syndicated deals.

Chart 2: Green Treasury Bond allocation

Allocation by investor type

Allocation by geography

Source: AOFM

Green Treasury Bond roadshow and investor engagement

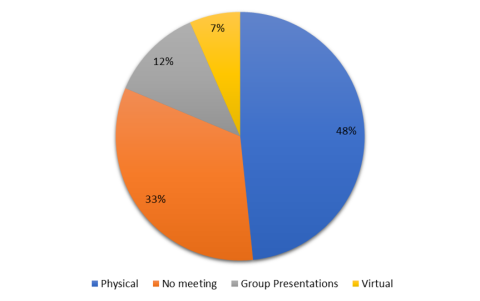

Prior to the launch of the deal, the AOFM undertook a four-week Green Treasury Bond roadshow to provide information to investors about the green bond program and framework, projects that will be financed, and plans for the syndicated issue. The first two weeks involved a physical roadshow conducted in Australia, Asia, the United Kingdom, and Europe and included 84 in-person meetings and four group presentations attended by 34 investors. The last two weeks of the roadshow included 29 virtual meetings with investors not previously seen during the roadshow.

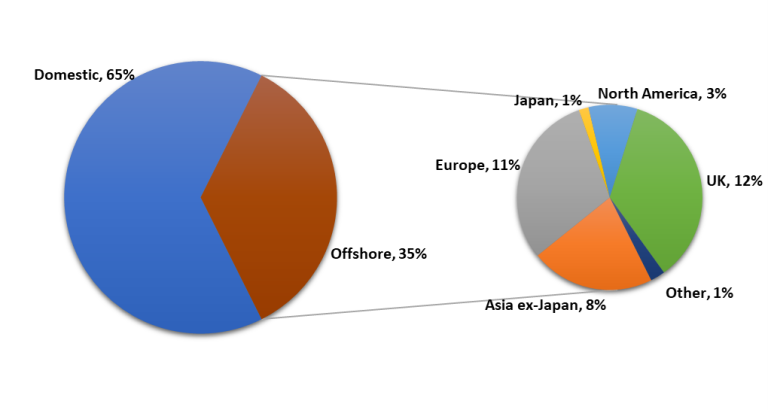

34% of the investor meetings during the roadshow were with domestic investors, followed by 25% in the UK, and 23% in Asia. Around two thirds of investor meetings were held with fund managers (Chart 3).

Chart 3: Green Bond investor meetings

Investor meetings by type

Investor meetings by geography

Source: AOFM

The AOFM received a positive response and high engagement from investors during the roadshow. The investors demonstrated strong interest and involvement by asking a wide range of questions and expressing support for the program and the Framework. The discussion topics included Australia’s climate change policies, alignment of the green bond framework with the country’s net zero goals, eligible project pool for the June 34 Green Treasury Bond, excluded categories, developing a green curve, development of Australian Taxonomy, and liquidity of the green lines.

Key messages from the deal roadshow:

- Investors noted that they supported the program and provided positive feedback on the framework. They were pleased to see the alignment of the framework with ICMA Green Bond Principles. They noted that the framework covers important aspects of Australia’s climate change and environmental challenges.

- Some investors who the AOFM engaged with during the consultation process for the development of the Green Bond Framework noted that they were happy to see their feedback being reflected in the framework.

- Investors had noted that the green bond program is a big step for Australia in the right direction.

- Investors were inclined to support the bond in the primary deal as there is a scarcity value attached to the bond.

- Discussions also revolved around the relative value of the bond, liquidity and pricing.

- There were also some discussions around a possible greenium with some noting that they would accept some greenium.

- Comments also focused on the scarcity of the bond in the secondary market, with investors understanding that the primary deal may be the best way to obtain a good allocation.

- While some investors focused on the relative value of the bond, the AOFM also met with many investors who were strong supporters of Australia’s sustainable finance strategy and who had noted that they would be supporting the bond in the primary deal.

The AOFM was pleased to observe a strong turnout at the syndication. Out of the 91 unique investors (105 including bank trading accounts) who participated in the deal, the AOFM had met 61 investors as part of the roadshow. This represents a rate of 67%, which is a significant indicator of investor engagement and support. 48% of the investors the AOFM met in the physical one-on-one meetings participated in the deal (Chart 4).

Chart 4: Allocation to investors by engagement type (excluding Trading banks)

Source: AOFM

Green Treasury Bond syndication vs conventional Treasury Bond syndications

The Green Bond Framework outlines the process for project evaluation and selection. Green Treasury Bonds are Use of Proceeds bonds, which are specifically designated for financing green projects.

Conventional Treasury Bonds have no restrictions on the use of proceeds and can be utilised for a wide range of government expenditures. The size of the bond is influenced by various factors, including government’s funding requirements and market conditions. In contrast, the size of the Green Treasury Bond was determined based on the available project pool of eligible green expenditures. As such, the size of the deal was capped at $7 billion.

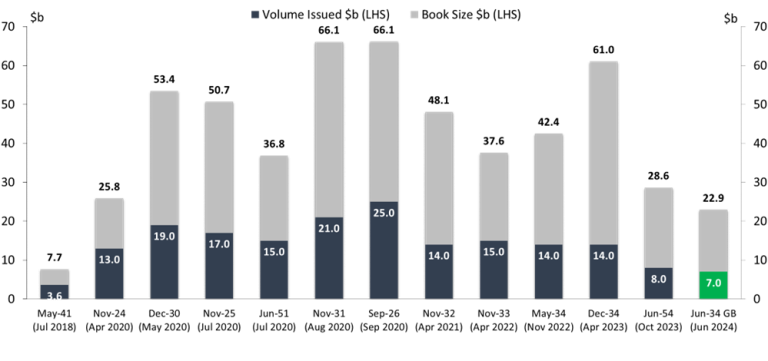

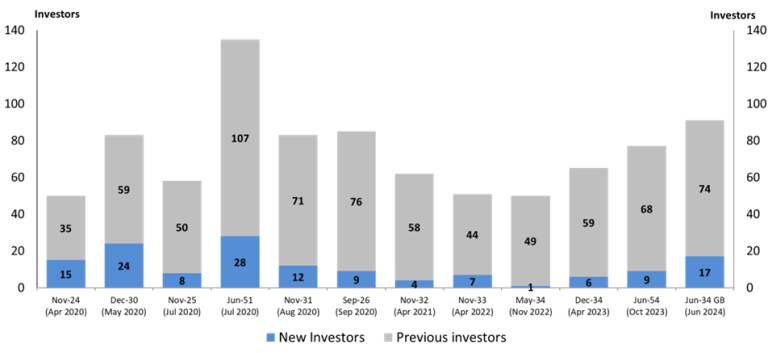

Despite the comparatively modest size of the bond issue, the deal attracted strong demand from investors. The Green Treasury Bond was the smallest new bond syndicated issue since the May 2041 deal in 2018 and attracted the lowest orderbook size since that deal (Chart 5). Due to the volume cap, there was substantial scaling of investor bids.

Chart 5: Deal size and book size in syndicated deals

Source: AOFM

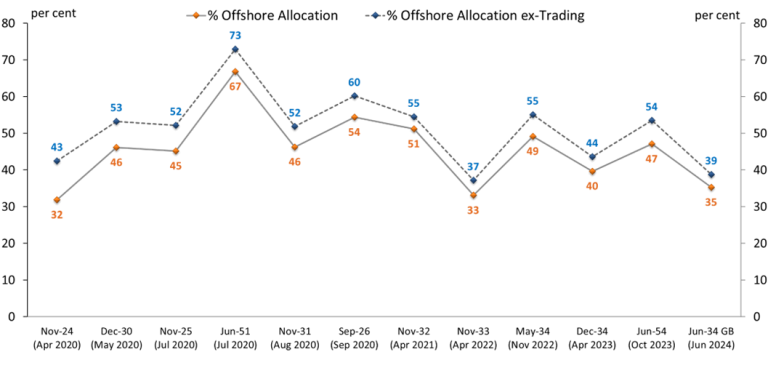

The bond issue was supported by international investors with around 39% (excluding trading banks) allocated to them (Chart 6). Geographically, participation of the UK investors was consistent with previous syndication deals. Participation from investors based in Asia was lower, while participation from Europe investors saw an increase (11%) compared to previous syndication deals (Chart 7). One of the reasons for this could be the higher number of ESG-focused investors in Europe than Asia.

Chart 6: Offshore allocation in syndicated deals (ex-Trading Banks)

Source: AOFM

Chart 7: Breakdown by geography (including Trading Banks)

Source: AOFM

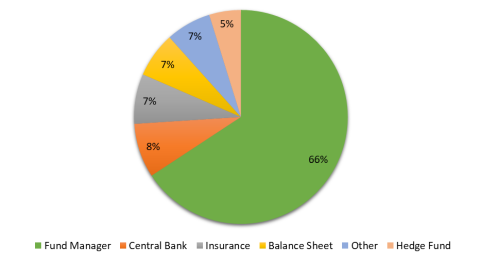

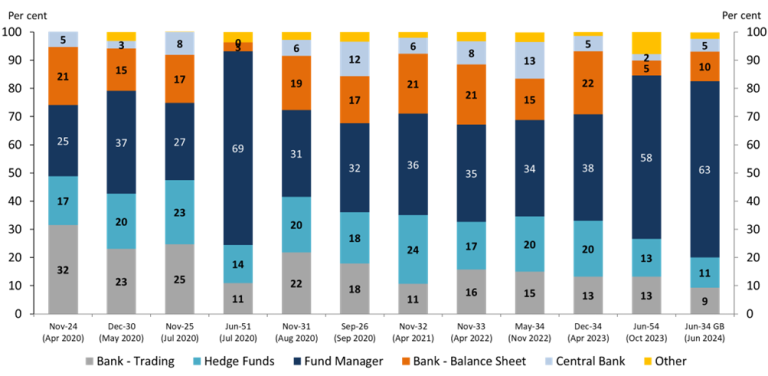

The June 2034 green bond had a much higher allocation to fund managers (63%) than similar maturity bonds and looked more like an ultra-long bond for fund manager allocations. Allocations to balance sheets (10%) and central banks (5%) were slightly lower than similar tenor bonds, however they were much higher than recent ultra-long issues. The overall allocation to ‘real money’ of 80% was the highest of any deal, reflecting the smaller size of the deal and a relatively high amount of scaling of trading and hedge fund orders. Chart 8 shows investor breakdown by type in syndicated deals in the last few years. The AOFM believes that one reason why the overall allocation to ‘real money’ was higher in this deal is because of the label of the bond and consequently more investors focusing on ESG in the ‘real money’ sector.

Chart 8: Investor breakdown by type in syndicated deals

Source: AOFM

Along with boosting the scale and credibility of Australia’s green finance market, supporting Australia’s net zero transformation and environmental objectives, an additional objective of the green bond program was to contribute to further diversification of the AGS investor base. Chart 9 reflects the new investors in the green bond deal and compares it with the deals in the past few years. Out of the 91 individual investors in the deal, 17 investors were new to syndications. Only syndications of 30-year bonds have attracted more investors. The AOFM believes the influx of new investors in the syndication deal can be attributed to the extensive deal roadshow and attraction of a new category of investors (dark green) due to the label of the bond.

Chart 9: New investors in syndicated deals

Source: AOFM

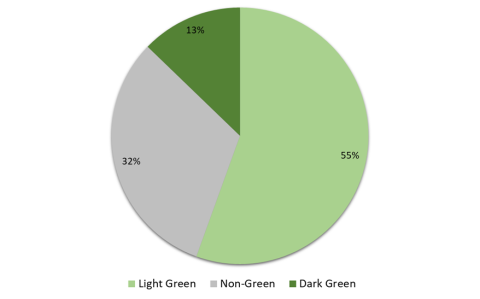

Green Bond investor categories

The AOFM has attempted to categorise the investors who participated in the deal into Dark Green, Light Green, and Non-Green categories. The categorisation is done based on investor feedback during the roadshow, guidance from a JLM bank, how the investors integrate ESG into their portfolios, and if the investors are a signatory to the United Nations Principles for Responsible Investment (UN PRI). To be categorised as a Dark Green investor in this classification, investors must apply ESG screening, have green investment mandates, have confirmed during previous engagement that they apply ESG, and be signatories to the UN PRI. Please note that classifications are purely on an inference basis and should not be used as a definitive guide.

Chart 10: Green Bond investor categories (by allocation amount)

Source: AOFM

55% of the deal amount was allocated to Light Green investors, who apply ESG screening to their portfolio or integrate ESG into their portfolios in some way (Chart 10). This reflects a growing trend among investors to align their investments with environmental impact. The data shows a broader pattern where domestic investors, often in the Light Green category have shown a significant interest in the deal. The participation of Light Green domestic investors highlights local interest in supporting Australia’s net zero transformation goals and environmental objectives.

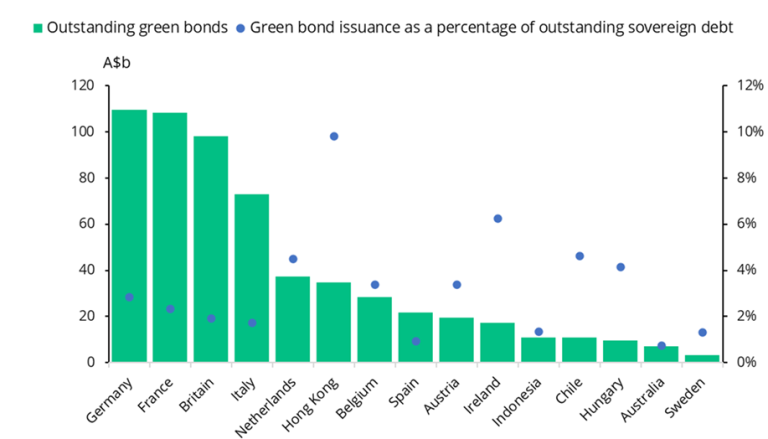

In contrast to the previous deals, the green bond deal saw a smaller allocation to offshore investors. Moreover, allocation to Dark Green investors was the smallest among the three categories. The AOFM believes that a smaller allocation to Dark Green investors could be because Dark Green investors are primarily located offshore with easier access to a significantly larger sovereign green bond market, where Australian green bond represent a relatively minor segment.

Chart 11: Green Bonds on issue across sovereigns

Source: Bloomberg, as at 28 June 2024

Outlook for the Green Bond Program

Green Treasury Bonds will form a regular program of issuance. The AOFM places a high importance on liquidity of all the lines on issue and as such building the June 34 line remains one of the priorities. The AOFM announced on 28 June that around $2 billion of Green Treasury Bonds will be issued at tenders in 2024-25.

The AOFM will continue to engage with investors on all aspects of the green bond program. The AOFM will also focus on developing a ‘curve’ in subsequent years by establishing new green bond lines.

Each year, the Green Bond Committee will assess new Eligible Green Expenditures for inclusion in the project pool. A list of projects that are eligible for financing using the proceeds of Green Treasury Bond issuance is available on the AOFM website.

In line with ICMA Green Bond Principles and commitments made in the Green Bond Framework, Australia will provide annual transparent reporting on the allocation of proceeds towards Eligible Green Expenditures (allocation reporting), as well as the positive environmental impacts of those expenditures (impact reporting). Social co-benefits will be identified where possible. Reports will be published on the AOFM website from 2025.

[1] Different geographical regions of the same parent investor are counted individually