Issue 3 | AOFM Investor Insights | January 2020 | PDF

This edition of Investor Insights is on the Australian Government Securities (AGS) investor base.

AOFM is often asked, ‘Who owns Australian Government Securities?’

The AOFM issues AGS to financial intermediaries in the primary market who act as market makers by buying and selling AGS to investors and other market makers. This means that holders of AGS are continually changing without the AOFM being a party to secondary market transactions.

The AGS market appeals to investors for its strong credit, deep liquidity, the availability of sophisticated hedging instruments, and Australia’s comprehensive legal and regulatory framework. Factors affecting investor demand include outright yields; global relative value; the liquidity of the market; the level of the Australian dollar relative to other currencies; and hedging costs.

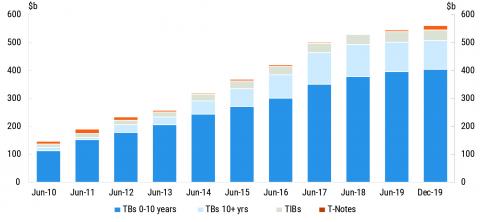

Chart 1 shows AGS on issue over the last ten years during which the Treasury Bond (TB) yield curve was gradually extended to 30 years, up from around 12 years in 2010.

Chart 1. AGS outstanding by security type

Who owns Australian Government Securities?

The majority of AGS are held in the Austraclear settlement and depositary system owned by the Australian Securities Exchange (ASX). AOFM makes coupon and/or principal payments through Austraclear to the Austraclear participant (the holder recorded in Austraclear). Around two-thirds of AGS are held in nominee and custodial accounts. The AOFM is unable to compel the provision of information by the registered owners of securities or by persons holding securities on their behalf. This limits the information available to the AOFM on the beneficial ownership of AGS.

Within these limitations, several sources provide broad information on the AGS investor base:

- Data published by government agencies, including the ABS, RBA, the IMF, and foreign governments;

- Secondary trading activity by investor group and by geography;

- AOFM syndicated issuance[1] (bonds sold directly to investors rather than via intermediaries); and

- Regular engagement by the AOFM with financial intermediaries and investors.

Non-resident holders of AGS are widely-spread geographically and cover a range of investor types (see Table 1). Domestic investors primarily include managed funds, superannuation funds, insurers, and bank balance sheets.

Table 1: Major categories of AGS investors

| Sector | Holding characteristics |

|---|---|

| Central banks - hold AGS as part of their overall foreign exchange reserves. | Typically have a higher weighting to short-dated maturities |

| Asset managers - includes domestic and offshore fund managers, pension funds, insurers, and sovereign wealth funds. | Hold AGS across the curve, however pension funds and life insurers with long-dated liabilities have a bias towards long-dated tenors. |

| Hedge funds - use short-term financing to fund trading positions in AGS. | More likely to trade the most liquid bond lines comprising the 3 and 10-year futures contracts. |

| Bank balance sheets - Domestic banks hold AGS in part to meet regulatory requirements. Offshore banks may hold AGS to offset their AUD liabilities. | Can hold AGS across the curve but have a preference for tenors less than 12 years, with a higher weighting to 3 and 10-year basket bonds. |

A view through available official data

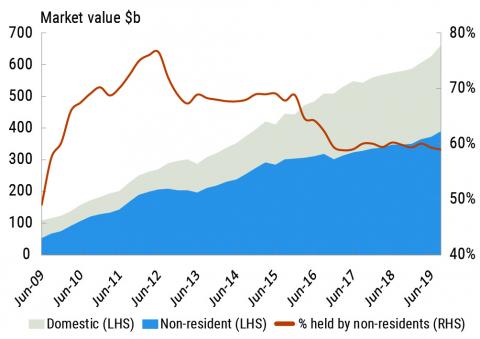

The proportion of AGS held by non-resident investors has remained relatively constant over the last two years at around 60 per cent. This has come down from a high of about 76 per cent in 2012. The reason is primarily that non-resident demand did not keep pace with the rate of issuance by the AOFM, rather than it being a result of net selling. Indeed, the market value of non-resident holdings has risen from around $207 billion in June 2012 to $389 billion in September 2019.

Chart 2: Non-resident and domestic holdings of AGS (repo adjusted)

The following are some of the larger represented sectors that are influential in the AGS market.

Non-Resident Investors

Central bank foreign currency reserves managers

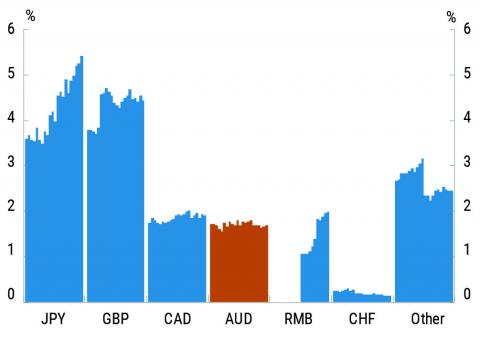

Foreign currency reserves managers are significant holders of sovereign debt, including AGS. As of June 2019, reserves managers held around $US11.5 trillion in foreign currency, of which about $US188 billion was allocated to AUD.[2] Chart 3 shows that the proportion of AUD held by reserves managers has been relatively constant over the last five years at 1.6% to 1.8% of total holdings. Around two-thirds of the top 50 largest reserves managers have indicated to the AOFM they hold AGS. AGS forms a core part of central banks’ AUD allocations since they place high importance on capital preservation and liquidity. Typically their AGS holdings are weighted toward shorter-dated maturities, although there are exceptions to this, with some seeking higher returns and diversity in longer-dated bonds and other assets including semi-government and corporate bonds as well as equities.

Chart 3. Central Bank FX reserve allocation outside of USD & EUR Jan-2014 to June-2019

Japanese Investors

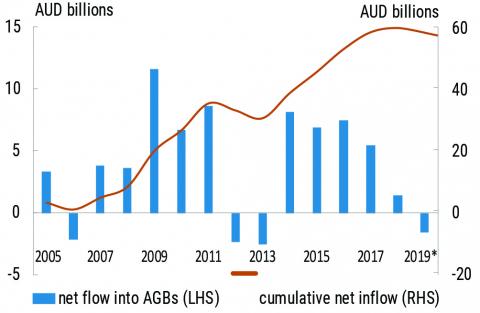

Japan has been the single largest investor in Australian fixed income by country, with a large pool of savings, including pension funds and life insurance assets. Persistent low yields in Japanese government bonds over a long period have led Japanese investors to seek higher returns and diversity outside of Japan, including Australia. Based on data published by the Bank of Japan as of December 2018, total Japanese holdings in AUD fixed income was around $250 billion representing approximately 7% of their overall fixed income allocation. Chart 4 shows that net flow into AGS and semi-government bonds (semis) is around $58 billion since 2005.

Chart 4 Net flow into Australian Government Bonds (AGS and semis) by Japanese investors

Hedge Funds

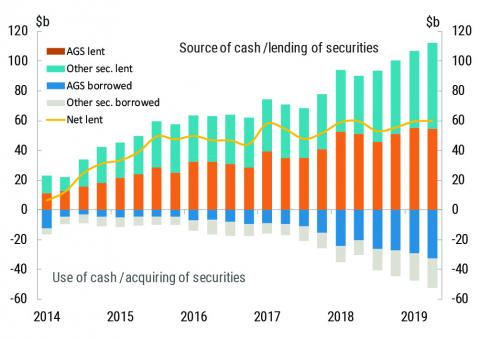

Offshore hedge funds have been active participants in AGS for some years. Some are opportunistic and trade in and out of positions rapidly while others hold positions for longer periods. Many fund their positions in AGS through the repo market, so the availability and cost of repo are important factors in their ability to hold AGS. Chart 5 shows the increase in non-resident repo activity. Hedge funds have primarily driven the growth in using repo to fund their holdings of AGS.

Chart 5. Non-resident repo market activity – by security

Domestic Investors

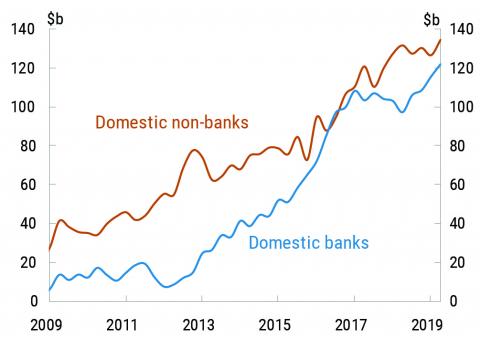

Domestic investors hold around 40 per cent of AGS on issue, of which domestic bank balance sheets hold about half. Demand by banks for AGS is underpinned by regulations that require them to maintain a certain quantity of high-quality liquid assets (HQLA), which includes AGS and semi-government bonds.

Chart 6. Domestic bank and non-bank holdings of AGS

Domestic non-bank investors include fund managers, superannuation, and insurance funds. Australia has the fourth-largest pool of pension assets in the world[3] with around $2.9 trillion in superannuation assets as of June 2019. Australian fixed interest allocation in superannuation is about 13% which is low by global standards but is significant in absolute terms and is likely to increase as the pool of savings grows.

The Australian fixed income proportion includes an allocation to AGS along with semi-government bonds and corporate bonds. Most fund managers benchmark their returns to an index, the most common used by domestic investors being the Ausbond Composite 0Y+ index of which around 50% is comprised of AGS. Some fund managers match the performance of the index by holding proportional weights of each security in the index, while many seek to outperform their benchmark by holding a different proportion of AGS to the index.

Retail Investors

Retail investors comprise a minimal amount of direct holdings of AGS. These holdings were acquired through the RBA retail investor facility which was closed in May 2013. Retail investors hold a larger amount through indirect channels, including through Exchange-traded Australian Government Bonds, which provide beneficial ownership of AGS in the form of Chess Depositary Interests (CDIs). Around $200 million of CDIs are on issue.

The more significant way retail investors are exposed to AGS is through managed funds, including superannuation, in which fund managers invest in AGS on behalf of underlying investors. In these cases, the legal owner is the financial institution which acquired the AGS or their custodian.

A view through secondary market turnover

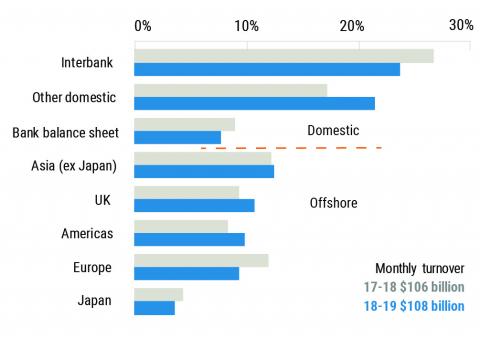

The AOFM collects secondary market monthly turnover (trading) data directly from market makers. These data are categorised by investor sectors and regions. In 2018-19 TB turnover (both buying and selling of TBs by market makers) was around $1.3 trillion, which corresponds to just over two times the total amount of AGS on issue.

Chart 7 shows TB turnover by investor type and region and is split by domestic and non-resident investors. After removing interbank transactions between market makers, around 62 per cent of TB turnover was transacted with offshore counterparties, which correlates well with non-resident holdings data published by the ABS (see Chart 2. Non-resident holdings of AGS).

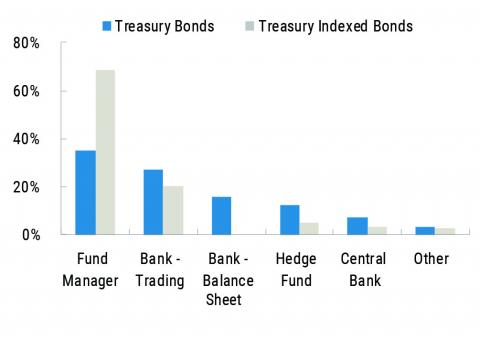

Chart 7. Treasury Bonds secondary market turnover

The turnover data show trading of AGS over a period of time, and while not directly comparable to outright holdings, it is complementary. For example, it is likely that outright holdings of AGS is higher than that indicated in the turnover chart for bank balance sheets and also Japanese investors since these investors are more likely to ‘buy and hold’ rather than trade frequently.

A view through the AOFM lens

Syndicated issuance

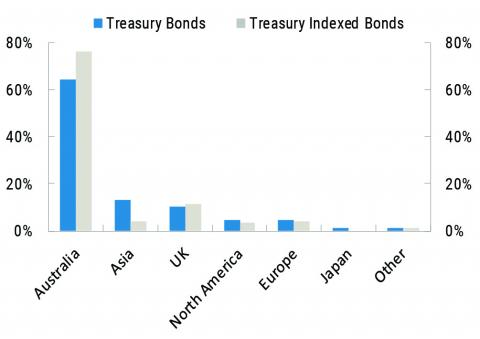

Syndicated issuance allows the AOFM to directly see which investors participate, unlike tenders in which there is no direct visibility of where bonds are on-sold. Since 2011, the AOFM has issued around $114 billion by syndicated issuance with the majority of issuance in TBs and a smaller percentage in TIBs.

Chart 8. Geographic distribution of syndications excluding trading banks

Across all syndicated deals, around 46 per cent of TBs have been distributed to non-residents and 30 per cent for TIBs. The higher domestic concentration for TIBs reflects the more concentrated domestic investor base for TIBs. By comparison, the overall non-resident holdings of AGS is much higher at around 60 per cent (see Chart 2). One explanation for this is that many non-resident investors buy AGS from market makers in the secondary market rather than through the primary market. The convenience and liquidity of the secondary market can often make it an easier and more flexible option for some types of investors.

More than a third of TB syndications and two-thirds of TIB syndications have been allocated to fund managers which includes asset managers, insurers and pension funds.

Chart 9. Investor diversification by type

AOFM Investor Engagement

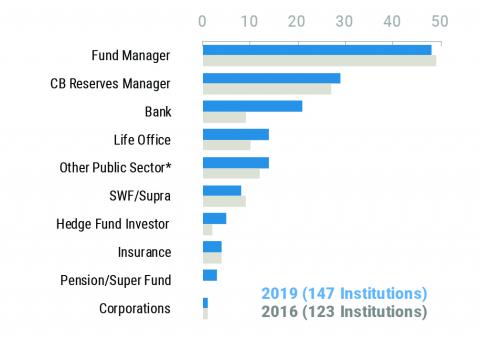

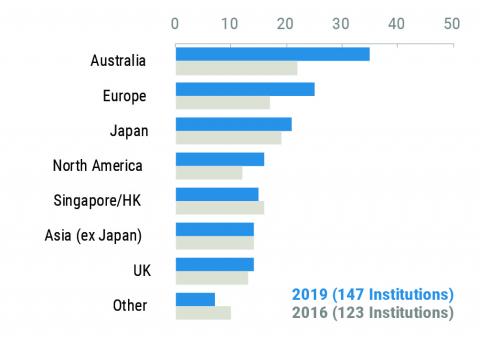

The AOFM has developed a strong understanding of the AGS investor base (there are likely to be hundreds of institutional holders of AGS at any point in time). To help plan market engagement activities, the AOFM has focused on ‘key investors’. This view evolves over time with changes in investor holdings, or as the relative importance of different sectors and regions change. In general, a ‘key investor’ would have a significant holding of AGS or have the potential to be a large holder. They may also be active in the secondary market or have been sizable participants in syndicated deals.

Chart 10. Key investors by investor type

Chart 11. Key investors by geography

Conclusion

The AGS market has developed significantly over the last ten years and has attracted a diverse range of investors by sector and geography. The AOFM does not target a specific investor composition for AGS, and nor could it since AGS are traded freely in competitive markets. A diverse investor base is desirable since it helps liquidity in the AGS market while reducing the possibility that a majority of investors will react in the same way to market events, which could in turn impact the AOFM’s ability to undertake its issuance program.

Understanding and supporting investor diversity remains a strong focus of the AOFM’s activities.