4th Australian Government Fixed Income Forum

Rob Nicholl, CEO

Once again it is a pleasure for the AOFM to host this event and the positive response on your part is very encouraging. Thank you for attending.

It remains the case that Japan is important to Australia in a number of ways. Historically, the tendency has been to look at the relationship through trade flows, but I like to think that this forum has also served to highlight the significance of the relationship in terms of Japanese investor interest – with our focus today of course being on fixed income assets.

I will leave it to Dr Kent from the RBA to overview dynamics of the Australian fixed income market. We have also arranged sessions specifically on the semi-government and securitisation sectors, together with a panel session that will give insight into views about the Australian fixed income market from some prominent fund managers – including for the first time some perspectives from the Tokyo investment community.

But my role today is to update you on issuance plans for the AOFM on behalf of the Australian Government. I will also take the opportunity to highlight changes we have noted in the investor base. I will not be going into detail but touching on some key themes.

As you have just heard from the Secretary to the Australian Treasury Mr Fraser, the Budget outlook remains strong and the most recent forecast is for a continuation of the fiscal consolidation that has been gradually taking effect for the past 7-8 years.

This progress has been influenced by several key factors: policy decisions to restrict growth in outlays, while balancing fiscal settings during a period of below trend GDP growth; persistent GDP growth; and recent sustained revenue growth.

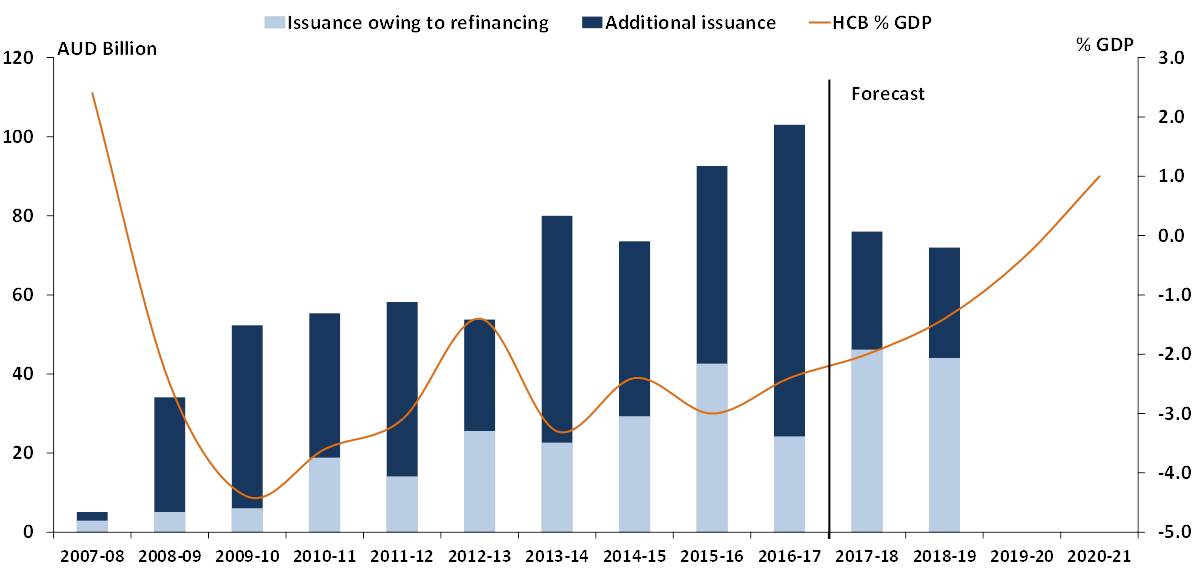

Chart 1: AOFM Issuance and Budget Position

Chart 1 shows two things for the period between the GFC and this year.

The Australian Government headline cash balance as a proportion of GDP and AOFM nominal bond issuance - the lower light bars indicate re-financing required each year and the upper dark bars show net issuance.

The chart indicates that sustained fiscal improvement underlies what will be a shift in emphasis for the AOFM’s issuance task - from one of financing Budget deficits to one of re-financing maturities. The recent Budget forecasts indicate that by the end of next year (2019-20) the headline cash balance will again be zero and then returned to surplus the year after in - 2020-21.

One consequence of this change is that after 9 years of increasing issuance tasks and active market development, the AOFM will now be using issuance to consolidate rather than extend its portfolio and market development objectives.

From an issuance program of around $36 billion immediately following the global financial crisis, about 15% funded maturities. This year about 60%.of gross issuance will fund maturities and bond buybacks.

For the year ahead planned gross issuance is $75 billion – of which $70 billion will be in nominal bonds and the remaining $5 billion will be inflation linked bonds. Gross issuance will reflect around $45 billion in refinancing and around $30 billion in net new issuance.

The inflation linked bond market remains around 8.5% of the overall debt portfolio. While this market attracts steady offshore interest, around 3/4 is held by Australian investors, which is one of the reasons I haven’t included these numbers on the chart.

In the year ahead regular weekly issuance will be maintained, combined with several syndications to establish new maturities. These will be a new 5-year bond line to support the 3-year futures contract; two new 12-year bond lines to support the 10-year futures contract; and a new 23-year bond line to support the 20-year futures contract.

This pattern of new bond lines – a continuation of what we have been doing for a number of years - reflects a long-held undertaking to support the futures contracts. However, they have also been an important mechanism for us to manage funding risk. As our issuance programs decline with the improving Budget position, we will more closely review the pattern of having two bond lines per year. This is to avoid detracting from liquidity by having volumes outstanding in any particular bond line that are persistently below market needs for trading efficiency.

There is now also a regular buyback program targeting bond lines short of the 3-year futures basket; this is funded by an equivalent amount of new issuance further along the yield curve. While discretionary, we see this operation as prudent overtime because it will benefit efficiency of the market by removing bonds that would otherwise sit on bank trading books, while improving the AOFM’s ability to manage funding risk.

Chart 2: Treasury Bonds on issue

Chart 2 aims to reflect some of these factors. It shows each of our nominal bond lines in total face value amount outstanding - of which there are 24 – together with the amounts that were outstanding at the beginning of this fiscal year (the dark barks) and our issuance pattern this year (the light bars). Note that the futures basket bonds are highlighted by the 3 shaded panels.

The key things I would like to highlight are: (1st) the heaviest issuance has been into the 10-year futures basket, which is where demand continues to be greatest; (2nd) we have established two new maturities to support the 3 and 10-year futures contracts and we have looked to build those new lines quickly to liquid levels; and (3rd) the average bond line size is $15.5 billion (with the average for the 10 largest lines being $21 billion).

Chart 3: Curve extension and long issuance bias

Chart 3 shows changes to the average term-to-maturity of the nominal bond portfolio, together with lengthening of the yield curve that has occurred over the period following the GFC. Once again the focus here is on nominal bonds.

It was around 2010-11 that we began to lengthen the yield curve, with staged maturity increases being to 15, 20 and then 30 years. The dark curve shows that the first 20-year benchmark line was established in 2014 and for the first 30-year benchmark bond line this was in late 2016. Having established these benchmarks we have gone on to launch three additional new 20-year benchmark bond lines – and as I just said a fourth is planned for later this calendar year. We are also planning to establish a new 30‑year benchmark bond sometime after July 2019 – this will be a 2051 maturity.

Development of the very long-end of the yield curve has both required and provided opportunity for a high proportion of new issuance into this sector. Over the last 4-5 years around 60% of the program on average has gone into 10‑year futures bonds and longer. As a result, the average term-to-maturity of the portfolio has increased from just over 5 years to its current level of 7½ years – this is around the OECD average.

Introducing the buyback program, refining our use of syndications, continued regular weekly tenders, balancing the concentration of issuance for liquidity with establishing new lines to support diversity, and extending the yield curve have all combined to leave the AOFM with operational flexibility.

Chart 4: AGS Turnover - Treasury Bonds year ending 30 June 2017

Before commenting on the nature of the investor base I would like to spend a moment on secondary market liquidity. Chart 4 shows from data collected directly by the AOFM turnover in our market for last year (2016-17) – it is broken down by region and domestic trade and bond maturity. Turnover in total for the year was just over $1 trillion – or about $90 billion per month.

Around half of that turnover was in maturities of between 2 and 9 years – which includes the 3‑year futures contract. Just under a quarter of total turnover was in 10‑year futures basket bonds and around 10% was in very long maturities.

About two thirds of turnover was domestic, with bank balance sheets now accounting for around 10% of that; fund managers accounting for 20% and interbank trades comprising about 30%.

Offshore trades were concentrated out of Europe and Asia – but Japan and the UK alone accounted for over 10%. This is a reflection of the fact that Tokyo and London remain the most important cities in terms of the concentration of offshore AGS investors. Tokyo still remains the most concentrated city of these investors, which is why we have been holding this forum here over a number of years.

This brings me to some comments about the nature of the investor base and changes we have noted over the past few years.

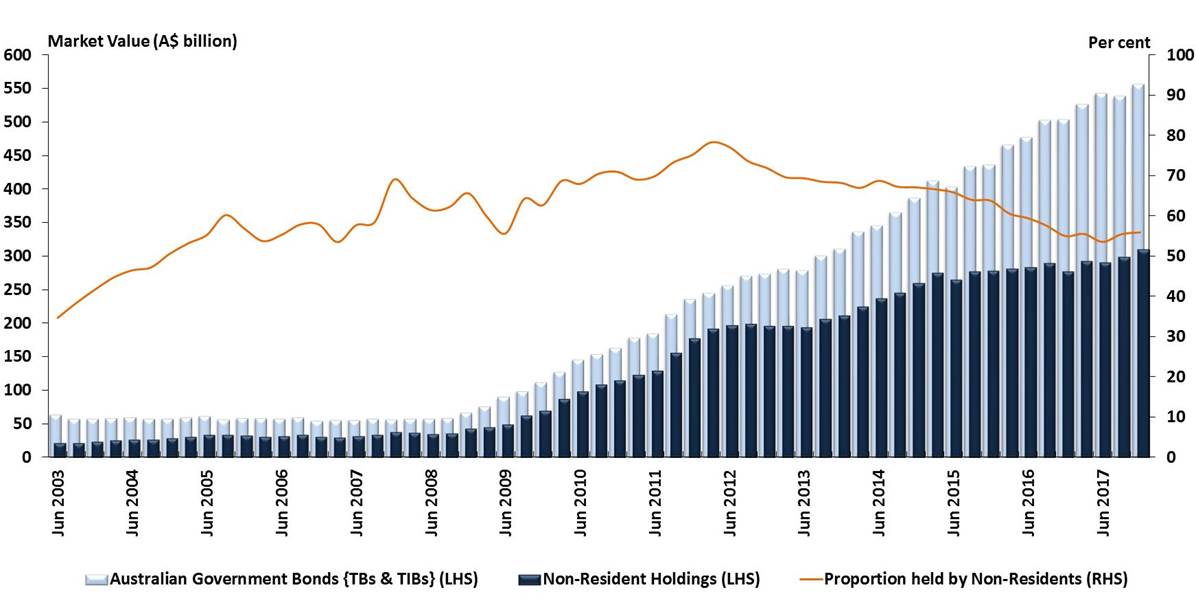

Chart 5: Resident and non-resident holdings

Chart 5 shows the total market value of bonds outstanding; the total amount of that paper owned by offshore investors; and the proportion as offshore ownership. It covers the period from 2003 to now.

At first glance a few things stand out – one is a gradual decline since early 2012 in the proportion of offshore ownership. Another is relatively sharp increases in the market value of bonds held offshore during the periods 2011-2012 and mid-2013 to mid-2015.

Looking at the 2nd factor we know that during these periods central banks bought a lot of our bonds. The number of central banks in the market increased more than four-fold during that time and collectively they absorbed a lot of new issuance as they built their portfolio allocations. After late 2014 the number of central banks allocating into the $AUD for the first time slowed sharply.

As the yield curve was lengthened to 30 years this attracted a different type of new investor looking for a yield advantage in a liquid currency. You would not be surprised to hear that pension funds and various types of insurers have been prominent amongst these – and once again there is strong offshore representation.

However, you can see from the chart that the rate of offshore buying did not match the increased rate of new issuance and a large part of that difference has been accounted for by domestic bank balance sheets and fund managers. The bank balance sheets now hold just under 20% of the sovereign market.

Then there are passive offshore and domestic fund managers, which are an increasingly large group of investors in our market because AGS constitute about 2% of global indices. They are less focused on trading relativities than active fund managers and hedge funds.

Of the remaining offshore investors, there are many that focus on currency-hedged returns. The outright yield spread is less a focus for them too although hedging costs are highly relevant.

Investors that rely on funding their positions through access to repo have been an important marginal buyer over past years but the recent changes to the cost and availability of repo is something that could have a more lasting impact on these investors depending on whether the recent changes are structural.

In the past we were often asked whether the high proportion of offshore ownership reflected a risk and whether we had a view as to an appropriate level of offshore investor participation. In recent years we have been asked the opposite – that is if declining offshore ownership is of concern.

Us expressing a desired balance between domestic and offshore ownership would be based on arbitrary judgement – which is one reason we don’t do it.

We think a more important point is that the Australian Government is neutral as to where its bonds are held, leaving investors to determine their holdings based on factors determined by relative value and related factors.

There are also two other factors underpinning attractiveness of the market to offshore investors – one is Australia’s sovereign credit rating and the other is liquidity of the market (something that is the result of a number of influences, including strong market making participation by the banks; issuance patterns; and the volumes outstanding of individual bond lines).

Together, these factors have served to attract a diverse range of investor and this to us seems more important than the domestic/offshore balance in itself.

But the last few months have signalled the possibility for further change in the investor mix. As I noted, short-end money market conditions have the potential to weigh on the participation of price sensitive and leveraged investors. This may or may not lead to a further rebalancing in the market.

Changes to monetary policy settings globally is also a potentially major factor and something that has all sovereign issuers (not just the AOFM) wondering what this might mean for asset price levels generally, but just as importantly what the relative value and risk outlook between asset classes might be. While not something the AOFM has a better ability to anticipate than anyone else, we remain confident that careful planning for the operational flexibility we maintain leaves us well placed to deal with a wide range of possibilities as they emerge.

Let me conclude by saying that in the context of a strong and improving fiscal outlook with gradually declining finance tasks I would argue that the overall Australian picture looks to be very positive.

Thank you.